In the current retail market scenario, there are different channels through which a sale is executed, i.e., Retail Stores and E-commerce Websites/Apps. However, GINESYS had a provision to enter sale information of only Retail Stores and not E-commerce sale. From the Ginesys HO Version 11.111.0, it is possible to update the same.

Channels enabled in GINESYS:

Demystifying the newly added Channels:

- Unmanaged Owned (COCO) Store sale: The store is owned by the organization but since the store is an Exclusive Brand Outlet (EBO), the POS software is integrated with Brand’s central database. Due to this Sale & Stock information was not available in GINESYS.

- E-commerce sale: We have classified the e-commerce sale on the basis of its "Fulfillment center", i.e., from where the goods/items shall be dispatched -

- Fulfilled by Marketplace

- Fulfilled by Seller (where sale can take place from marketplace as well as seller’s own web store).

Difference between "Fulfilled by Marketplace" and "Fulfilled by Seller"?

The major difference between the two is that the stock in case of fulfilled by marketplace is sent by the seller to marketplace’s warehouse. In case of fulfilled by seller the stock of the goods is in seller’s warehouse itself.

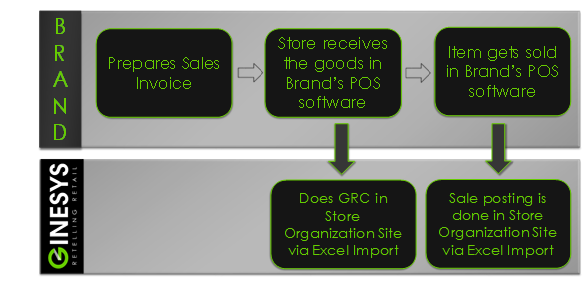

Process flow for Unmanaged COCO Store:

- Business Scenario - Consider a store which is owned by you but it is an exclusive brand outlet of brand 'ABC'. Due to this, 'ABC' brand shall enforce their software which shall sync information to their database. Previously, even if you wanted to keep your software, i.e., GINESYS updated with the receive/sale information of that store, there was no such provision for the same. Now after this update you can do so by creating a new organization site for that store and do normal Goods Receive and post the sale information by using the process specified below.

- Key Highlights -

- We will create an Organization Site (OS-OO-CM) for such outlets.

- Tax/VAT posting shall be done in exclusive mode.

- MOP Control A/C shall be debited until the transaction amount is received by Head Office.

Note: MOP Control A/C will be sub-ledgers of "others class" having AR/AP ledger tagged to it.

- Process Detail -

- On purchase of goods for that store from the Brand, goods receive document shall be created manually by connecting to that organization site.

- On sale of goods from that store in the Brand software, an excel can be generated from that store and can be imported in GINESYS using new import excel option into that organization site.

- On importing the sale, MOP Control A/C shall get debited and on receipt of money at HO, it can be set-off in AR voucher or via document adjustment.

- Sample Masters:

Site Name - Elgin Road Store (ABC Brand)

MOP Control A/C - Elgin Road Store (ABC) Control A/C

Process flow for Fulfilled by Marketplace E-commerce Sale:

- Business Scenario - Consider a scenario where you list your products in 'Flipkart'. Also, you send the goods to a Flipkart's warehouse, i.e., 'Bhiwandi Warehouse' for order and dispatch.

- Key Highlights -

- We will create a customer (consignment) and then unmanaged customer's site for such outlets.

- Tax/VAT posting shall be done as per the mode specified in customer master.

- Customer A/C shall be debited until the transaction amount is received by Head Office.

- Process Detail -

- GINESYS user transfer's stock from its warehouse to customer/marketplace site location.

- Consumer purchases goods from marketplace and the marketplace delivers those items from their warehouse itself to the consumer.

- Marketplace then shall share the sale information in excel format to GINESYS user who in turn shall import using new import excel option for that marketplace site.

Sample Values:

Site Name - Bhiwandi Warehouse - Flipkart

Customer Name - Flipkart

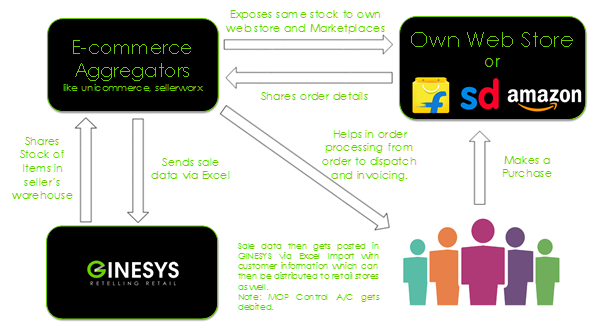

Process flow for Fulfilled by Seller E-commerce Sale:

- Business Scenario - Consider a scenario where you list your products in 'Flipkart'. But the order information is shared by Flipkart to you and you further process the order and dispatch.

- Key Highlights -

- We will create an Organization Site (OS-OO-CM) for such warehouses.

- Tax/VAT posting shall be done in exclusive mode.

- MOP Control A/C shall be debited until the transaction amount is received by Head Office from Marketplace.

Important information

Note: MOP Control A/C will be sub-ledgers of "others class" having AR/AP ledger tagged to it.

- Process Detail

- GINESYS exposes stock information of the organization site to third party 'E-commerce Aggregators'.

- 'E-commerce Aggregators' then further exposes same stock information to all the marketplaces / own web-store.

- Consumer purchases goods from marketplace/own web-store.

- This order information will get available in e-commerce aggregator website via their integrations with marketplaces/own web-store.

- Order processing to dispatch/invoicing needs to be done in E-commerce Aggregator's website.

- After invoicing, they will generate an excel which can be imported in GINESYS using new excel import option for that organization site.

- Sample Values:

Site Name - E-commerce Fulfillment Center

MOP Control A/C - Flipkart Control A/C

This article is a collation of all articles that will enable creation and management of Retail Sale through GINESYS in the mentioned order. Retail Sale is divided into two parts - Store and E-Commerce.

- Store - Store is a place of business usually owned and operated by a retailer. Sometimes owned and operated by a manufacturer or by someone other than a retailer. Goods and Services are sold primarily to ultimate consumers in the store.

Three types of stores are present in the Ginesys - Owned, Franchise (Consignment) and Franchise (Secondary). - Owned - A place of business usually owned and operated by a retailer or by a manufacturer or by someone other than a retailer.

- Franchise (Consignment) - The authorization of a Franchise Store is granted by the owner. The consignment shop and the owner split the profits after selling the items. If any item does not sell after a certain period of time, the owner has the ability to retrieve the items from the consignment shop. If the Franchise (Consignment) is Managed Store, then the price of the items (without MRP) will be decided by the owner. For the Unmanaged Franchise (Consignment), the price of the items might be decided by the store also.

- Franchise (Secondary) - The authorization of a Franchise (Secondary) Store is granted by the owner. The Franchises buy the items from the owner to resale but the owner does not claim the profit after selling. The price of the items (without MRP) might be decided by the Franchises.

- E-Commerce - E-commerce, an abbreviation for Electronic Commerce, is the platform for buying and selling of goods and services over an electronic network, primarily the internet. These business transactions occur either as Business-to-Business (B2B), Business-to-Consumer (B2C), Consumer-to-Consumer or Consumer-to-Business.

- Fulfilled by Marketplace - In this scenario the order items are maintained by a particular E-Commerce site.

- Fulfilled by Seller - In this scenario the order items are maintained by a particular Seller.

Changes in menu name (Version 12.8.0 - 2.8.0)

- “Fulfilled by Seller” is now renamed as "Billing by Brand" because When the brand is selling goods and brand is liable to pay the output tax, then it should be posted in this menu.

- “Fulfilled by Marketplace” is now renamed as "Billing by Marketplace" because When the brand is sending goods to marketplace warehouse, marketplace is billing and marketplace is liable to pay the output tax, then it should be posted in this menu.

Manual Scheme Document Number allowed (Version 12.8.0 - 2.8.0)

Manual scheme document number is now allowed. From now -

User can select manual numbering and provide the number against which the document needs to be imported in UI.

- User can select manual numbering and map the document number column In excel.

Note

For using the manual number, the user needs to first tag the manual number to the menu.

Impacted Modules:

UI / Excel Import: Provisions done as mentioned above.

New Public API / ERP <> OMS (Browntape): Always manual.

Old API (used for existing e-com OMS integrations): Always manual.

GST credit note numbering enabled for return transactions (Version 12.8.0 - 2.8.0)

GST credit note against B2B online sale returns can be done now.

If GST credit note numbering is selected, system will only allow return items to be populated, no sale items.

Impacted Modules:

UI / Excel Import: Provisions done as mentioned above.

New Public API / ERP <> OMS (Browntape): Always manual numbering and will be considered automatically as a GST Credit Note.

Old API (used for existing e-com OMS integrations): Always manual numbering and will be considered automatically as a GST Credit Note.

Transporter accounting now enabled (Version 12.8.0 - 2.8.0)

This change is applicable where the brands are using their logistics for shipping(not using marketplace logistics) and there is a Cash on Delivery (COD) or Pay on Delivery (POD) transaction.

Current accounting in retail sale used to debit the “MOP Control A/C” or Channel (renamed, details mentioned below separately) even though the amount was to be received from the transporter due to COD/POD. Now while creating the transaction, if COD/POD amount is provided, transporter selection will be mandatory, and the transporter will be debited instead of channel.

There can be partial COD/POD cases as well. In such case, upto the COD/POD amount transporter will be debited, for rest of the sale amount channel will be debited.

Impacted Modules:

UI / Excel Import / New Public API / ERP <> OMS (Browntape): Provisions done as mentioned above.

Old API (used for existing e-com OMS integrations): Not possible, works in existing way.

Delivery details can now be captured (Version 12.8.0 - 2.8.0)

Delivery details can now be captured along-with the retail sale transactions like awb number, shipping date, delivery date and transporter. These are non-mandatory fields and just for information capturing purposes only.

Impacted Modules:

UI / Excel Import: Provisions added while creating the transaction.

New Public API / ERP <> OMS (Browntape): Logistics update is a separate API which can be consumed after posting invoice.

Old API (used for existing e-com OMS integrations): Not possible.

Customer capturing revamp (Version 12.8.0 - 2.8.0)

- Now billing and shipping details can be captured against each transaction separately.

- Now only GST state code of billing details is mandatory for inter-state transactions.

Impacted Modules:

UI / Excel Import / New Public API / ERP <> OMS (Browntape): Provisions done as mentioned above.

Old API (used for existing e-com OMS integrations): Not possible, works in existing way.

Receiving good and damage returns in separate stock points (Version 12.8.0 - 2.8.0)

User can now provide the stock point at the item level when both the good and damage products are being received. If stock point is provided at item level, the stock impact for that item will take place in that stock point, else will take place in the header stock point.

This stock point has been added for only for return items.

Impacted Modules:

UI / Excel Import / New Public API / ERP <> OMS (Browntape): Provisions done as mentioned above.

Old API (used for existing e-com OMS integrations): Not possible, works in existing way.

Shipping / other charges with dynamic (max) tax is now possible from Excel Import / UI (Version 12.8.0 - 2.8.0)

Now “Dynamic Tax” field has been added at the item level and can be used from both excel import and UI.

In GST law perspective, if shipping charges are treated in the aforementioned way, it comes under a “Mixed Supply” case.

Impacted Modules:

UI / Excel Import / New Public API / ERP <> OMS (Browntape): Provisions done as mentioned above.

Old API (used for existing e-com OMS integrations): Not possible, works in existing way.

GST charge in case of Export can now be configured (Version 12.8.0 - 2.8.0)

From now Users can mark the LUT status in the GSTIN master. Accordingly while creating e-com transactions, GST calculation will be done.

Impacted Modules:

UI / Excel Import / New Public API / ERP <> OMS (Browntape): Provisions done as mentioned above.

Old API (used for existing e-com OMS integrations): Already supported.

Introduction of Channel Master (Version 12.8.0 - 2.8.0)

Now with the Channel Master concept the user will have to select channel instead of mop control a/c.

Commission bill can be posted under the same channel SL which automatically gives the net receivable from the channel.

Note: Existing other type of sub-ledger (which has e-com transactions done against them) with AR/AP ledger tagged to it are automatically migrated to the channel class (master).

Impacted Modules:

UI / Excel Import / New Public API / ERP <> OMS (Browntape): Provisions done as mentioned above.

Old API (used for existing e-com OMS integrations): Provisions done as mentioned above.

Channel wise sales ledger now possible (Version 12.8.0 - 2.8.0)

From now “Sales ledger” field will be available in channel master. Previously, e-com sale transaction was done in the “Consignment Sales” ledger tagged in OU.

If the “Sales ledger” field is provided, the system will post the sale into that “Sales ledger” only instead of OU. This gives a flexibility to the users to maintain even channel wise sales (like amazon, flipkart, etc.).

Impacted Modules:

UI / Excel Import / New Public API / ERP <> OMS (Browntape): Ledger will be populated as per the new flow.

Old API (used for existing e-com OMS integrations): Ledger will be populated from OU (old flow).

Configuration added to specify which number to pick for GST returns (Version 12.8.0 - 2.8.0)

Existing working: The number used while creating the transaction was picked up for GST return purpose.

If created via UI or excel import, then Ginesys scheme document number was used.

If created via API, then marketplace / OMS scheme document number was used.

Changed behavior:

Document created using ERP scheme document number - The same number will be used for GST returns.

Document created using manual number / marketplace number / OMS number -

A flag in channel master “Allow ERP to generate auto GST doc number“ has been added.

If this flag is set to “Yes”, the system will auto create a number and put in GST doc number field which ultimately will be used for GST returns. However, payment reco can be done based on transaction number itself.

There are two system defined scheme numbers for this purpose, i.e., for Tax Invoice and for Credit Note.

Recalculate tax while posting via API now configurable (Version 12.8.0 - 2.8.0)

Now a flag has been added in channel master called “Recalculate Tax”. If this flag is enabled, the system will automatically recalculate the tax, else, the system will post the tax values supplied in the API call.

Impacted Modules:

New Public API / ERP <> OMS (Browntape): Provisions done as mentioned above.

Old API (used for existing e-com OMS integrations): Not possible, works in existing way, i.e., always recalculate.

Additional visible changes applicable for ERP <> OMS (Browntape) connected app integration (Version 12.8.0 - 2.8.0)

Retail Order

Online e-commerce order is posted into ERP as a Retail Order. Types of retail orders can be New (first sale order), Return, Exchange (Forward order against return).

This is a view only menu as retail orders can be created only via ERP <> OMS (Browntape) connected app API. Reason: An entire workflow is mapped with our OMS platform like reservation, picklist, confirmation, etc. Such operations of retail order is not possible from frontend.

Channel Master → “Is marketplace” field

This field is applicable only when channel is being configured for ERP <> OMS (Browntape) connected app integration.

If this field is set to “No”, then MOP with ledger needs to be specified while creating the channel. The usage of MOP is while pushing own web store’s retail orders which in turn creates deposit journals.

Add Comment