How To: Use the Net of Tax feature of Margin Rule

Margin is the profit to be earned by the retailer for sales of their products. Obviously if the margin has a tax component to it, the actual margin goes down. Hence, now there is an option to consider tax as outside the margin being set - Net of Tax feature in Margin Rule.

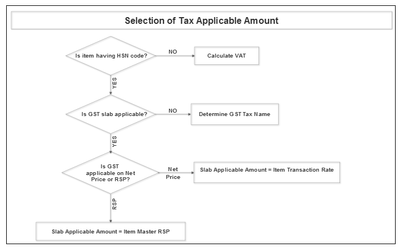

The selection of tax applicable amount is done in the following manner:

Tax for Markdown Calculation

If Rule Type = Cost to MRP

- If MRP is taken as: RSP, then Tax = (RSP X Tax Rate) / (Tax Rate + 100), Round off 2 decimal

- If MRP is taken as: MRP, then Tax = (MRP X Tax Rate) / (Tax Rate+ 100), Round off 2 decimal

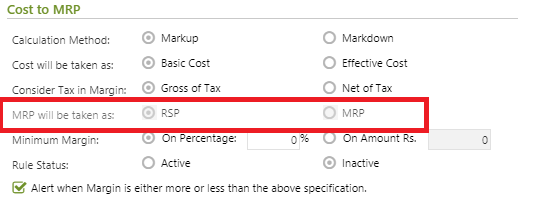

MRP will be taken as field in Cost to MRP section -

If Rule Type = Cost to WSP,

Tax = (WSP X Tax Rate) / (Tax Rate + 100), Round off 2 decimal

To easily understand the rest of the applicability of this feature; let us give this tax component a name - Markdown Tax; for both rule types - Cost to MRP or Cost to WSP.

Tax for Markup Calculation

If Rule Type = Cost to MRP

- If MRP is taken as: RSP, then Tax = (RSP X Tax Rate / 100), Round off 2 decimal

- If MRP is taken as: MRP, then Tax = (MRP X Tax Rate / 100), Round off 2 decimal

If Rule Type = Cost to WSP,

Tax = (WSP X Tax Rate / 100), Round off 2 decimal

To easily understand the rest of the applicability of this feature; let us give this tax component a name - Markup Tax; for both rule types - Cost to MRP or Cost to WSP.

In case of Basic Cost

| Mark Type | Tax Calculation | Percentage Based | Amount Based |

|---|---|---|---|

| Mark Up | Gross of Tax | ^^Proposed MRP = Rate + (Rate X Margin factor of MRP)/100 ^^Proposed WSP = Rate + (Rate X Margin factor of WSP)/100 ^^Proposed MRP and WSP are the MRP and WSP proposed by the system to the user if the margin rule validation fails. | ^^Proposed MRP = Rate + Margin factor of MRP ^^Proposed WSP = Rate + Margin factor of WSP ^^Proposed MRP and WSP are the MRP and WSP proposed by the system to the user if the margin rule validation fails. |

| Mark Up | Net of Tax | MRP before Net of Tax = Rate + ((Rate X Margin factor for MRP )/100) WSP before Net of Tax = Rate + ((Rate X Margin factor for WSP)/100) MRP Inclusive of Tax =MRP before Net of Tax+((MRP Exclusive of Tax X Tax Rate)/100) WSP Inclusive of Tax=WSP before Net of Tax+((WSP Exclusive of Tax X Tax Rate)/100)

| MRP before Net of Tax = Rate + Margin factor for MRP WSP before Net of Tax = Rate + Margin factor for WSP MRP Inclusive of Tax =MRP before Net of Tax+((MRP Exclusive of Tax X Tax Rate)/100) WSP Inclusive of Tax= WSP before Net of Tax+((WSP Exclusive of Tax X Tax Rate)/100)

|

| Mark Down | Gross of Tax | MRP Exclusive of Tax (where MRP taken as MRP) = MRP - (MRP X Margin factor for MRP)/100 MRP Exclusive of Tax (where MRP taken as RSP) = RSP - (RSP X Margin factor for MRP)/100 WSP Exclusive of Tax= WSP-(WSP X Margin factor for WSP)/100

If MRP Exclusive of Tax < WSP Exclusive of Tax, then Proposed Rate** = MRP Exclusive of Tax Otherwise, Proposed Rate = WSP Exclusive of Tax **Proposed Rate is the rate proposed by the system to the user if the margin rule validation fails. | MRP Exclusive of Tax (where MRP taken as MRP) = MRP - Margin factor for MRP MRP Exclusive of Tax (where MRP taken as RSP) = RSP - Margin factor for MRP WSP Exclusive of Tax= WSP- Margin factor for WSP

If MRP Exclusive of Tax < WSP Exclusive of Tax, then Proposed Rate** = MRP Exclusive of Tax Otherwise, Proposed Rate = WSP Exclusive of Tax **Proposed Rate is the rate proposed by the system to the user if the margin rule validation fails. |

| Mark Down | Net of Tax | MRP Exclusive of Tax (where MRP taken as MRP) = ((MRP - Tax on MRP) X (100 - Margin factor for MRP))/100 MRP Exclusive of Tax (where MRP taken as RSP) = ((RSP - Tax on MRP) X (100 - Margin factor for MRP))/100 WSP Exclusive of Tax = ((WSP - Tax on WSP) X (100 -Margin factor for WSP))/100

If MRP Exclusive of Tax < WSP Exclusive of Tax, then Proposed Rate** = MRP Exclusive of Tax Otherwise, Proposed Rate = WSP Exclusive of Tax **Proposed Rate is the rate proposed by the system to the user if the margin rule validation fails. | MRP Exclusive of Tax (where MRP taken as MRP) = (MRP - Tax on MRP - Margin factor for MRP) MRP Exclusive of Tax (where MRP taken as RSP) = (RSP - Tax on MRP - Margin factor for MRP) WSP Exclusive of Tax = (WSP - Tax on WSP - Margin factor for WSP)

If MRP Exclusive of Tax < WSP Exclusive of Tax, then Proposed Rate** = MRP Exclusive of Tax Otherwise, Proposed Rate = WSP Exclusive of Tax **Proposed Rate is the rate proposed by the system to the user if the margin rule validation fails. |

In case of Effective Cost

Effective Charge (Eff. Ch.) = Sum of Charges Included in Cost for the item

Consider Effective Charge only for the following two conditions:

- For Non-GST charges, if Charge include in Cost = 'Yes'.

- For GST charges, if ITC Eligibility = 'Not Applicable' in the item master.

| Mark Type | Tax Calculation | Percentage Based | Amount Based |

|---|---|---|---|

| Mark Up | Gross of Tax | Proposed MRP (exclusive of Tax) = (Rate + Eff. Ch.) + ((Rate + Eff. Ch.) X Margin factor of MRP/100) Proposed WSP (exclusive of Tax) = (Rate + Eff. Ch.) + ((Rate + Eff. Ch.) X Margin factor of WSP/100) | Proposed MRP (exclusive of Tax) = (Rate + Eff. Ch.) + Margin factor of MRP Proposed WSP (exclusive of Tax) = (Rate + Eff. Ch.) + Margin factor of WSP |

| Mark Up | Net of Tax | MRP before Net of Tax = Rate + ((Rate X Margin factor for MRP )/100) WSP before Net of Tax = Rate + ((Rate X Margin factor for WSP)/100) MRP Inclusive of Tax =MRP before Net of Tax+((MRP before Net of Tax X TaxRate)/100) WSP Inclusive of Tax=WSP before Net of Tax+((WSP before Net of Tax X TaxRate)/100)

| MRP before Net of Tax = Rate + Margin factor for MRP WSP before Net of Tax = Rate + Margin factor for WSP MRP Inclusive of Tax =MRP before Net of Tax+((MRP before Net of Tax X TaxRate)/100) WSP Inclusive of Tax= WSP before Net of Tax+((WSP before Net of Tax X TaxRate)/100)

|

| Mark Down | Gross of Tax | MRP Exclusive of Tax (where MRP taken as MRP) = MRP - (MRP X Margin factor for MRP)/100 MRP Exclusive of Tax (where MRP taken as RSP) = RSP - (RSP X Margin factor for MRP)/100 WSP Exclusive of Tax= WSP-(WSP X Margin factor for WSP)/100

If MRP Exclusive of Tax < WSP Exclusive of Tax, then Proposed Rate** = MRP Exclusive of Tax Otherwise, Proposed Rate = WSP Exclusive of Tax **Proposed Rate is the rate proposed by the system to the user if the margin rule validation fails. | MRP Exclusive of Tax (where MRP taken as MRP) = MRP - Margin factor for MRP MRP Exclusive of Tax (where MRP taken as RSP) = RSP - Margin factor for MRP WSP Exclusive of Tax= WSP- Margin factor for WSP

If MRP Exclusive of Tax < WSP Exclusive of Tax, then Proposed Rate** = MRP Exclusive of Tax Otherwise, Proposed Rate = WSP Exclusive of Tax **Proposed Rate is the rate proposed by the system to the user if the margin rule validation fails. |

| Mark Down | Net of Tax | MRP Exclusive of Tax (where MRP taken as MRP) = ((MRP - Tax on MRP) X (100 - Margin factor for MRP))/100 - Eff.Ch. MRP Exclusive of Tax (where MRP taken as RSP) = ((RSP - Tax on MRP) X (100 - Margin factor for MRP))/100 - Eff.Ch. WSP Exclusive of Tax = ((WSP - Tax on WSP) X (100 -Margin factor for WSP))/100 - Eff.Ch.

If MRP Exclusive of Tax < WSP Exclusive of Tax, then Proposed Rate** = MRP Exclusive of Tax Otherwise, Proposed Rate = WSP Exclusive of Tax **Proposed Rate is the rate proposed by the system to the user if the margin rule validation fails. | MRP Exclusive of Tax (where MRP taken as MRP) = (MRP - Tax on MRP - Margin factor for MRP) - Eff.Ch. MRP Exclusive of Tax (where MRP taken as RSP) = (RSP - Tax on MRP - Margin factor for MRP) - Eff.Ch. WSP Exclusive of Tax = (WSP - Tax on WSP - Margin factor for WSP) - Eff.Ch.

If MRP Exclusive of Tax < WSP Exclusive of Tax, then Proposed Rate** = MRP Exclusive of Tax Otherwise, Proposed Rate = WSP Exclusive of Tax **Proposed Rate is the rate proposed by the system to the user if the margin rule validation fails. |