Adding & Editing TDS Section Definition in Ginesys Web

TDS Sections are parts of Government fiscal decisions which legally define the rates of tax amount deducted at the source of financial transactions under various heads.

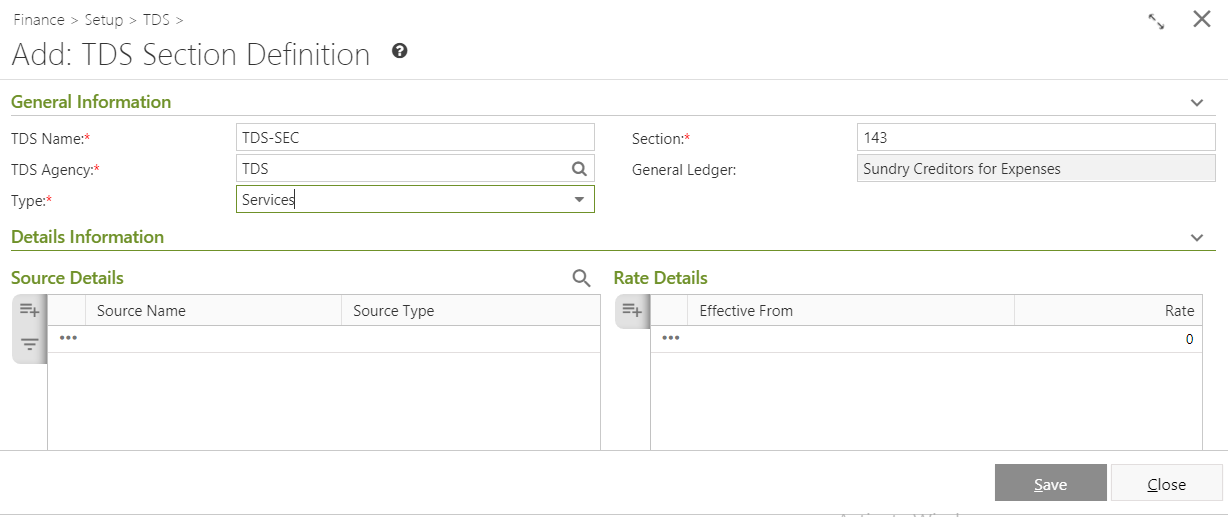

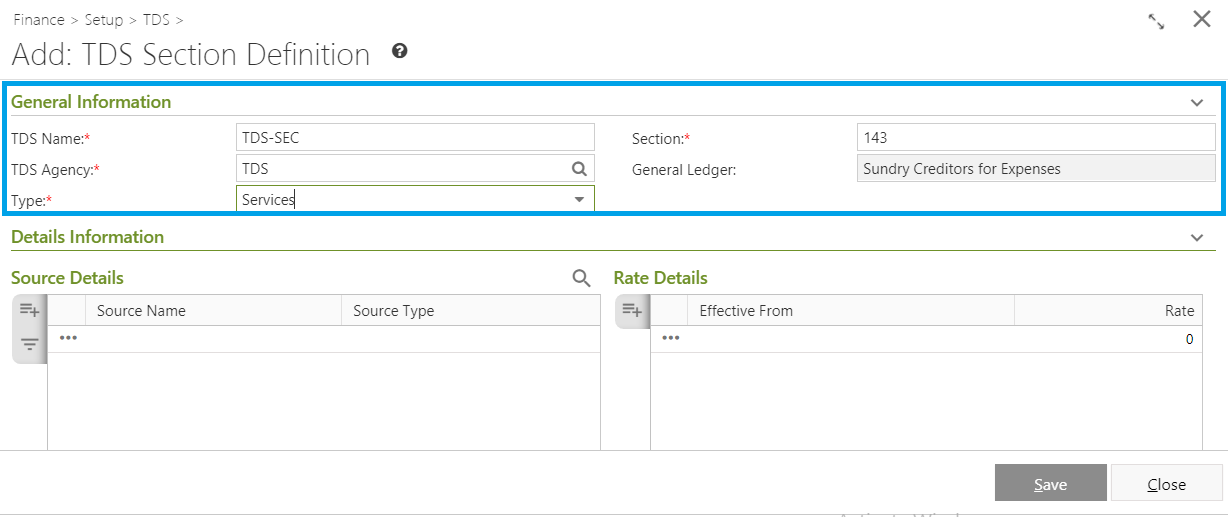

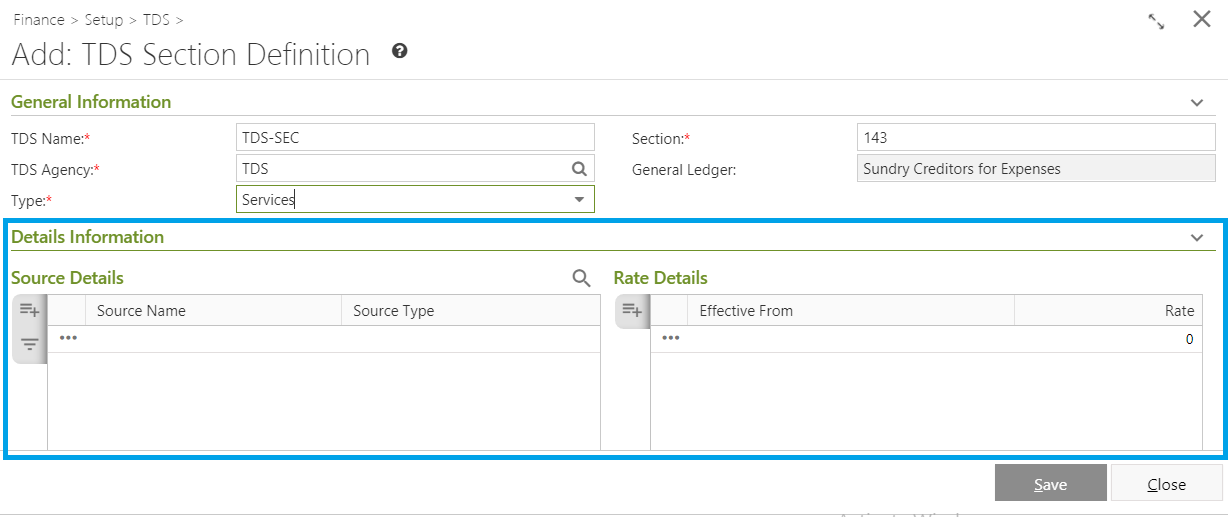

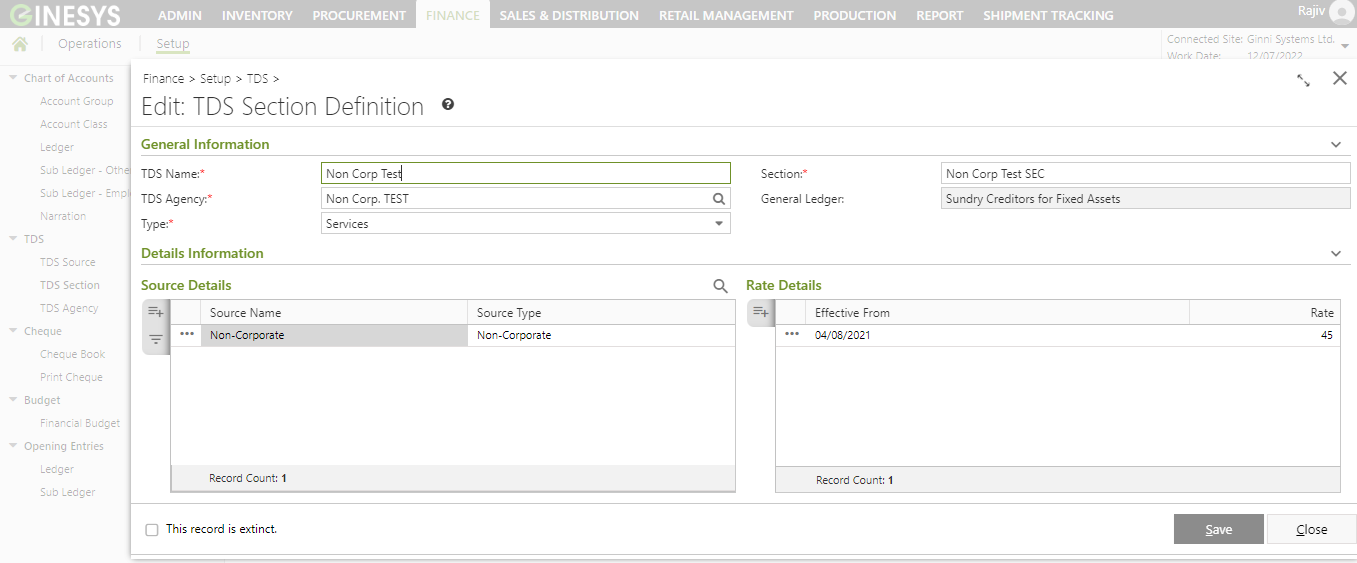

This Article describes the process of manage TDS Section.

Some important TDS Section

| Particulars | TDS Rate |

|---|---|

| Section 192: Payment of salary Section 192A: Premature withdrawal from EPF | Normal Slab Rate 10% |

| Section 192A: Premature withdrawal from EPF | 10% |

| Section 194: Payment of any dividend | 10% |

| Section 194A: Income in the form of interest (other than interest on securities) | 10% |

| Section 194D: Insurance commission | 5% |

| Section 194H: Commission or brokerage | 5% |

| Section 194O: For the sale of goods or provision of services by the e-commerce operator through its digital or electronic facility or platform. | 1% |

| Section 194P: Tax deduction by specified banks while making payments (pension or interest) to specified senior citizens or age 75 years or more. | Tax on total income as per rates in force |

| Section 194Q: Payments to residents for the purchase of goods if the aggregate value of goods exceeds Rs. 50 lakhs.(TDS is deductible on value exceeding Rs 50 lakhs) | 0.1% |

| Any Other Income | 10% |

You can only Extinct the record.

A new Type field has been added to differentiate Goods type and Service type of TDS Section master.

All the existing sections would be converted into Service type.

Online Printing option is now available from version 12.6.6 onwards.