You are viewing an old version of this content. View the current version.

Compare with Current

View Version History

« Previous

Version 19

Next »

Sometimes humans make mistakes in an entry or a transaction. This leads to discrepancies and a further reconciliation between the interacting parties is required. This anomaly may arise due to a machine malfunction as well. Such an improper situation in Retail business gives rise to the creation of Debit Notes or Credit Notes, wherever applicable. Debit Notes and Credit Notes are inevitable parts of retail business due to the process of returns. In GST regime, it is thus crucial for businesses to account for them.

A debit note in GST is a document issued by the supplier in the following cases:

- Increase in Taxable Value -When a supplier requires to increase the taxable value of a supply, he/she has to issue a debit note to the recipient.

- Increase in GST charged in invoice - When a supplier requires to increase the rate or value of GST charged in an invoice, he/she has to issue a debit note to the recipient.

Add Sales Debit Note

Prerequisites

- The users' role must have access to the Add app operation in the Sales Debit Note feature in Sales & Distribution - Operation - Invoicing through Roles in Ginesys Web - Admin - Security.

- Document Numbering Scheme must be present for the module.

Step-by-step guide

The process is divided into the following steps:

- Go to Ginesys Web > Sales and Distribution > Operations > Invoicing > Sales Debit Note.

- Sales Debit Note module will open.

- All the previously created Documents will be listed here.

- Click on Add button.

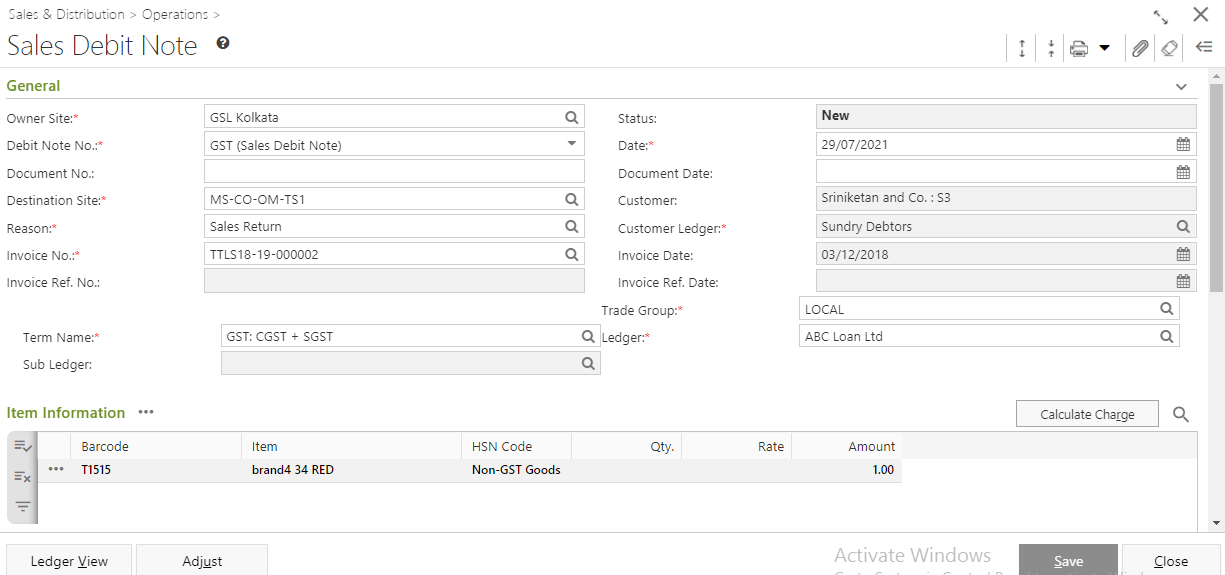

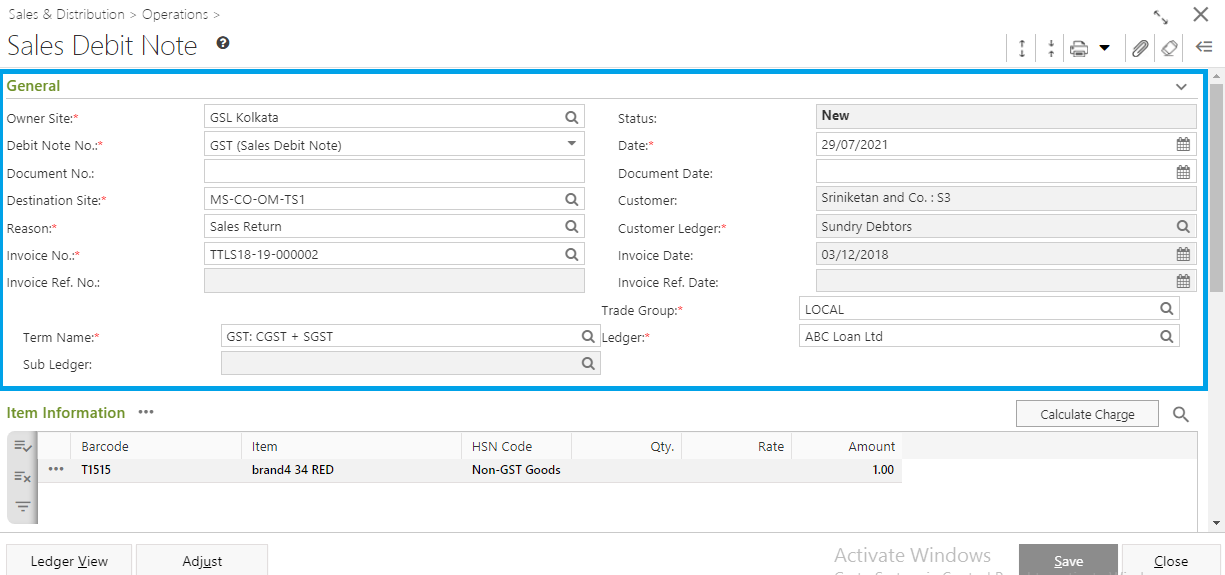

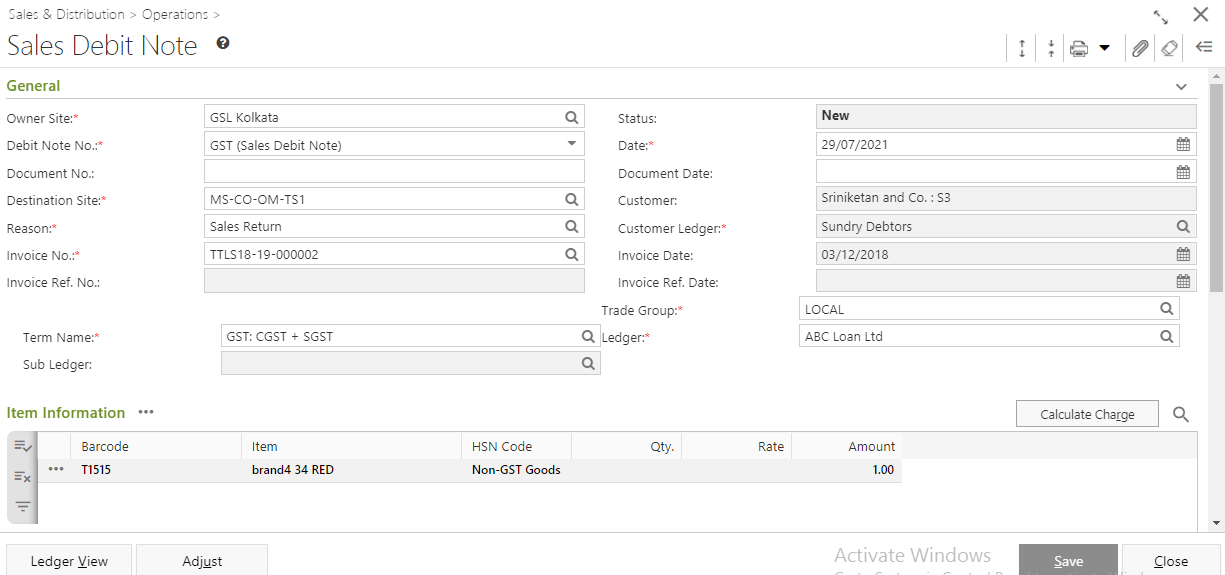

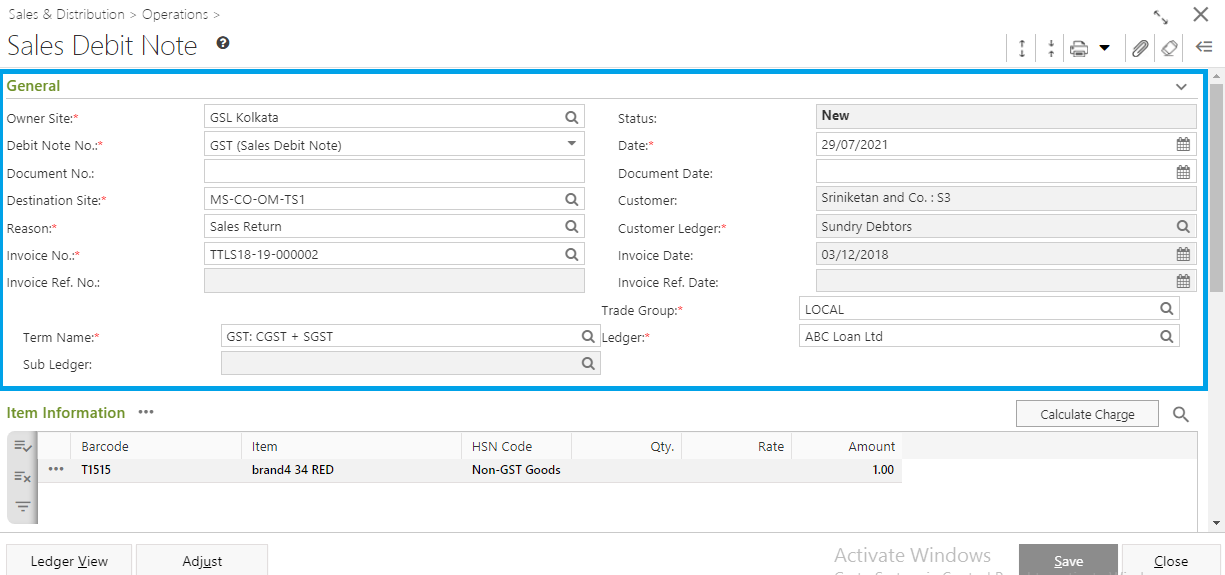

- Sales Debit Note window will open.

- You will get group of icons at the top right corner of the window

- Expand All: Clicking on this icon, all the sections will be Expand if they are collapsed.

- Collapse All: Clicking on this icon, all the sections will be Closed if they are expanded.

- Print Barcode: Clicking on the Down Arrow beside this icon, you will get Print Preference option. This option is used to print barcode.:

- Attachments: You can Upload some required documents from this option.

- Clear Form: Clicking on this icon, you can Clear all the data already entered.

- Open Side Panel: Clicking on this, you will get the details of the current Sales Debit Note as follows:

- Document Summary: In this section you will get the details of Selected Items, Sale Type, Owner Site, Modified by etc.

- Customer Details: You will get the Selected Customer Details like Address, Contact Details, Tax Region, Credit Limit, Overdue Amount etc.

- Customer Statistic: This section describes the Delivered not Invoiced amount, Outstanding Amount, Last Invoice Date etc.

- You will get three sections - General, Item Information and Others.

- General:

- Select the Owner Site (Mandatory Field) for which you want to create the Sales. By default, it will be populated with the connected site.(Owner Site wise General Ledger selection is applicable).

- Select Debit Note No. from the drop down list (Mandatory Field).

- Select the Destination Site (Mandatory Field) from the Destination Site Pop-Up form. Customer, Customer Ledger etc will be auto-populated as per Destination Site selection.

System date will be populated in the Date field (Mandatory Field). You can change the date as per your requirement. You can only select the past date from the system date but not any future date.

- Select Invoice No. (Mandatory field) from the Invoice No Pop-Up form. Trade Group (Mandatory field),Ledger (Mandatory field),Term Name (Mandatory field),Invoice Date, Invoice Ref No, Invoice Ref Date, Sub Ledger will be auto populated according to the selected Invoice No.

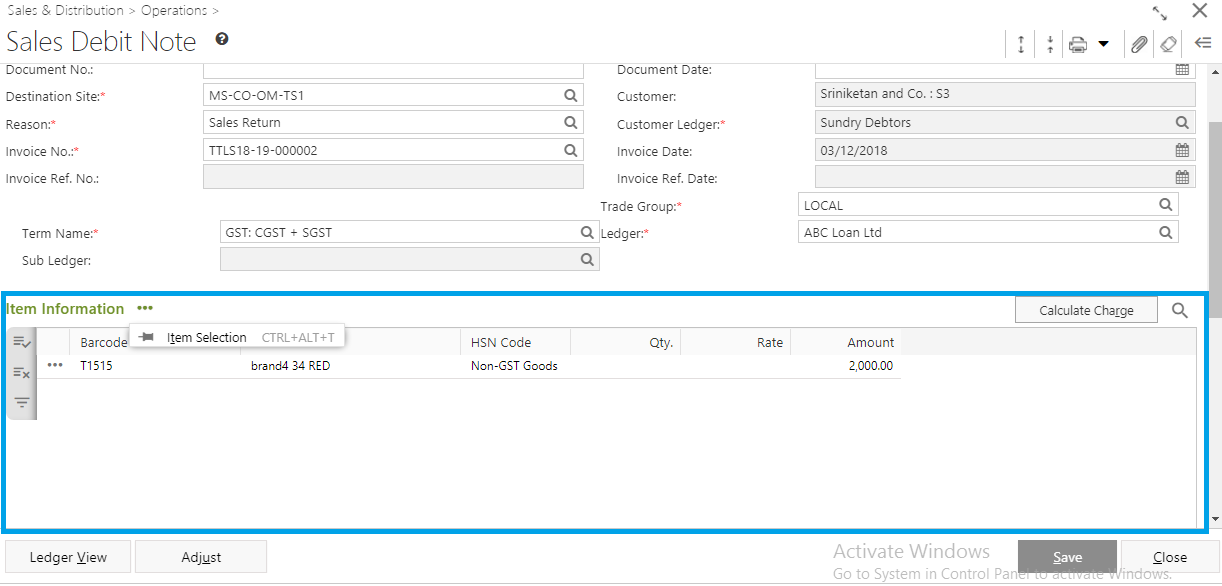

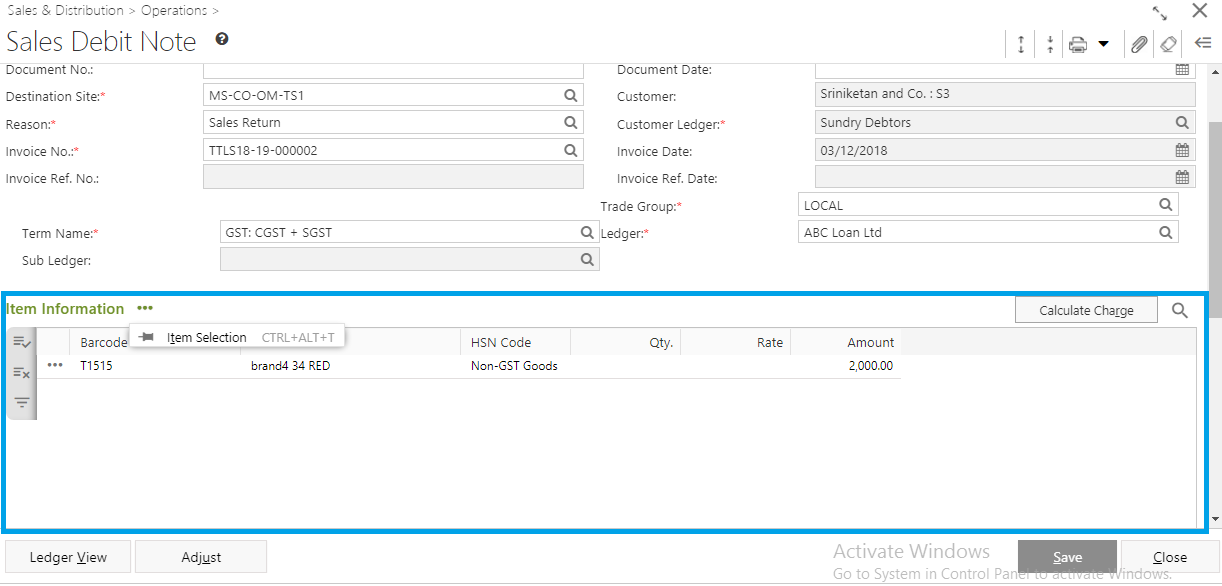

- Item Information:

- Select Item from Item Selection option.

- You will get Quick Population option - Amount and Percentage.

- You need to put value according to the selected option

Click on the Populate button.

- The Item(s) will be populated in the Item Information of the main window Barcode, Item, HSN Code, Qty, Rate, and Amount.

- If you click on the

button left side of the populated item, you will get a drop down list.

button left side of the populated item, you will get a drop down list. - You will get Delete Record, Item Charge and View Properties.

- Delete Record: You can delete the populated item from the list as per your requirement.

- Item Charge: The charges applied on the particular item will be displayed by clicking on this option. However, you may change the factors of the charges applied based on the settings in your user profile.

- View Properties: You can check the item details by clicking on this option. It will open the Item Master window but you cannot edit any details.

- Now you need to calculate Charge. Click on the Calculate Charge button. But even if you skip this step, charges applied will be automatically calculated on saving the form.

Charge will be calculated and the final amount after charge application will be populated as Net Amount.

You can also put in Remarks Of Others section.

- You will get the Ledger View and Adjust document to adjust document and get a overall ledger view.

- Click on the Save button to save Sales Debit Note. You will get a message "Document <Sales Debit Note No.> saved successfully."

Edit Sales Debit Note

Prerequisites

- The users' role must have access to the Edit app operation in the Sales Debit Note feature in Sales & Distribution - Operation - Invoicing through Roles in Ginesys Web - Admin - Security.

- Sales Debit Note must be created and un-posted.

Step-by-step guide

The process is divided into the following steps:

- Go to Ginesys Web > Sales and Distribution > Operations > Invoicing > Sales Debit Note.

- Sales Debit Note module will open.

- All the previously created Document.

- Select the Sales Debit Note you want to edit.

You can use Filter to search particular Sales Debit Note.

- Go to Action > Edit.

- Edit: Sales Debit Note window will open.

- All the details will be populated.

- You can modify Destination Site. You will get a message - "Change of Destination Site will clear the entry. Please confirm".

- You can add or remove item(s).

- Click on the Save button to save the modified Sales Debit Note.

You will get a message - "Document <Sales Debit Note No> saved successfully".

Delete Sales Debit Note

Prerequisites

- The users' role must have access to the Delete app operation in the Sales Debit Note feature in Sales & Distribution - Operation - Invoicing through Roles in Ginesys Web - Admin - Security.

- Sales Debit Note must be created.

- Sales Debit Note must be un-posted.

Step-by-step guide

The process is divided into the following steps:

- Go to Ginesys Web > Sales and Distribution > Operations > Invoicing > Sales Debit Note.

- Sales Debit Note module will open.

- All the previously created Document.

- Select the Sales Debit Note you want to delete.

You can use Filter to search particular Sales Debit Note.

- Go to Acton > Delete.

- You will get a message - "Record once deleted can not be retrieved. Please Confirm."

- If you click on Proceed, you will get a confirmation message "Debit No <> Document deleted successfully.".

Release Sales Debit Note

Prerequisites

- The users' role must have access to the Release app operation in the Sales Debit Note feature in Sales & Distribution - Operation - Invoicing through Roles in Ginesys Web - Admin - Security.

- Sales Debit Note must be created.

- Sales Debit Note must be un-posted.

Step-by-step guide

The process is divided into the following steps:

- Go to Ginesys Web > Sales and Distribution > Operations > Invoicing > Sales Debit Note.

- Sales Debit Note module will open.

- All the previously created Document.

- Select the Sales Debit Note you want to release.

You can use Filter to search particular Sales Debit Note.

- Go to Acton > Release.

- You will get a message - "Document(s) once released cannot be modified. Do you want to proceed?"

- If you click on Yes, you will get a confirmation message " Debit No<Sales Debit No:> - Released Successfully".

Revert Sales Debit Note

Prerequisites

- The users' role must have access to the Revert app operation in the Sales Debit Note feature in Sales & Distribution - Operation - Invoicing through Roles in Ginesys Web - Admin - Security.

- Sales Debit Note must be created.

- Sales Debit Note must be posted.

Step-by-step guide

The process is divided into the following steps:

- Go to Ginesys Web > Sales and Distribution > Operations > Invoicing > Sales Debit Note.

- Sales Debit Note module will open.

- All the previously created Document.

- Select the Sales Debit Note you want to revert.

You can use Filter to search particular Sales Debit Note.

- Go to Acton > Revert.

- You will get a message - "Selected document(s) will be un-posted, and finance postings done will also be reverted. Do you want to proceed?"

- If you click on Yes, you will get a confirmation message "Debit No<Sales Debit No:> : Reverted Successfully".

Print Sales Debit Note

Prerequisites

- The users' role must have access to the Print app operation in the Sales Debit Note feature in Sales & Distribution - Operation - Invoicing through Roles in Ginesys Web - Admin - Security.

- Sales Debit Note must be created.

- Printer must be connected and installed.

Step-by-step guide

The process is divided into the following steps:

- Go to Ginesys Web > Sales and Distribution > Operations > Invoicing > Sales Debit Note.

- Sales Debit Note module will open.

- All the previously created Document.

- Select the Sales Debit Note you want to print.

You can use Filter to search particular Sales Debit Note.

- Go to Acton > Print.

- You will get previously created template.

- Click on the required template to print.

- A new window will open.

The document will be printed.

Add Comment