What is Purchase Invoice?

PI (Purchase Invoice) is raised by the Purchaser after he receives the purchased goods from the Supplier. The Invoice bears all the details of the transaction with the total amount owed to the Supplier. If a Purchase Invoice is not created, then the Supplier account will not reflect the purchase amount in its ledger. Purchase invoice is issued by the purchaser to the seller for confirming the receipt of the order.

The current module outlines the general Purchase Invoice. For making an Invoice for Consignment purchase you have to raise it at Consignment Invoice module. Under this module you can only make Invoices for Non-Consignment purchase.

Purchase Invoice and Consignment Invoice are merged in the Ginesys web module. This article describes the process of manage Purchase Invoice in Ginesys web.

Add Purchase Invoice

Prerequisites

- The users' role must have access to the Add app operation in the Purchase Invoice feature in Procurement - Operation - Invoicing through Roles in Ginesys Web - Admin - Security.

- Supplier must be created.

- Site must be created.

- The document numbering scheme for Purchase Invoice must be present for the connected site.

The following masters need to be created and updated in Admin, Inventory and Procurement modules:

Admin module

- Roles - Application operations assigned for Purchase Invoice module.

- User Profile - User need to select the settings related to Purchase Invoice in Admin > Security > User Profile > Procurement Tab. New setting options related to GRT are given below:

- Display rate and value in Receipts and Returns (selected by default, may be de-selected if required).

- Allow rate modification in Adhoc Returns.

- Allow auto creation of Purchase Invoice and Purchase Invoice.

- Document adjustment is mandatory in Purchase Invoice.

- User - Role, Profile Policy and Sites to be assigned for Purchase Invoice.

- Document Numbering Scheme - Scheme needs to be created and tagged with Purchase Invoice module in Web.

- Organization Sites - Document numbering schemes tagged with Purchase Invoice module need to be allowed.

- Finance Month - Respective Finance Months for entry date should remain Open.

Inventory Module

- Item Group and Articles - Product hierarchy for the returned items should be defined. Articles, if separately maintained, must be created for respective items.

- Item - It is advisable that items returned should be created with respective Tax information before transaction entry.

- Stock Point - Location where the goods are to be stored need to be defined as Stock Points.

- GST/Tax Rate - Applicable tax rates for the period to be defined.

Procurement Module

- Vendor - Vendors, from whom the goods are purchased, must be defined with respective Terms and settings in Procurement tab. Ensure that applicable Trade Group and Purchase Order Booking Currency are selected for respective vendors.

- Charge - Charges applicable on the purchase made must be defined.

- Terms - Term applicable for the respective vendor must be defined.

- Assign Organization Site [Optional] - Only when the vendor is specific for any site, then assignment is required. If Trade Group/Terms etc differs for sites, then those need to be assigned here.

- Price Chart [Optional] - will be required only if made applicable for the vendor, and should be defined with respective items purchased.

- Margin Rule [Optional] - will be required only if user profile requires such setup.

- Margin Rule Allocation [Optional] - will be required only if Site wise - Vendor Wise - Article wise Margin is to be maintained.

Step-by-step guide

The steps are as follows:

- Go to Ginesys Web > Procurement > Operation > Invoicing > Purchase Invoice.

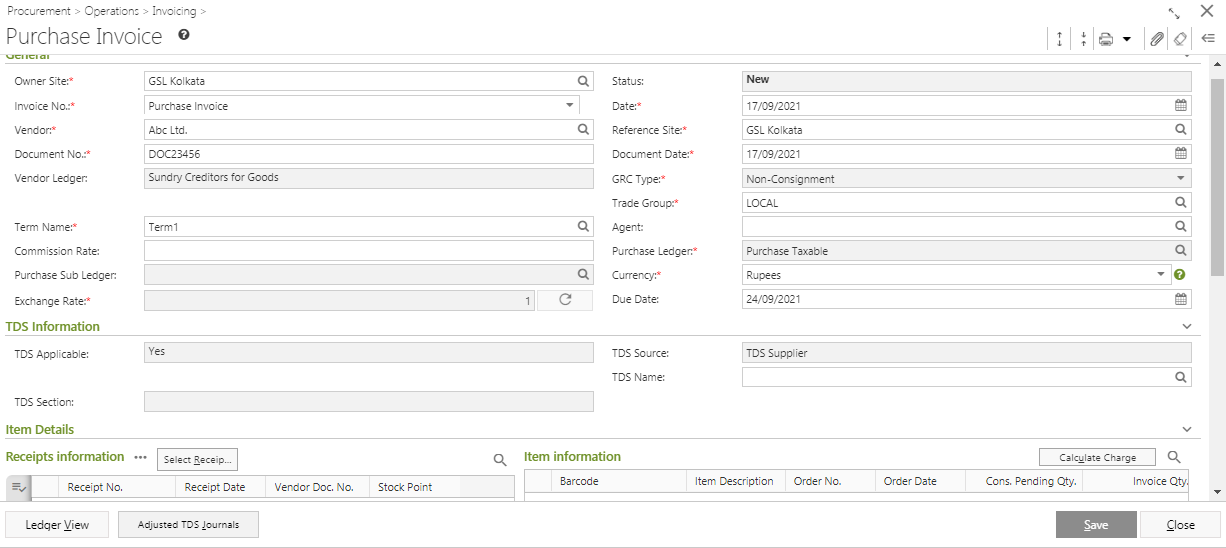

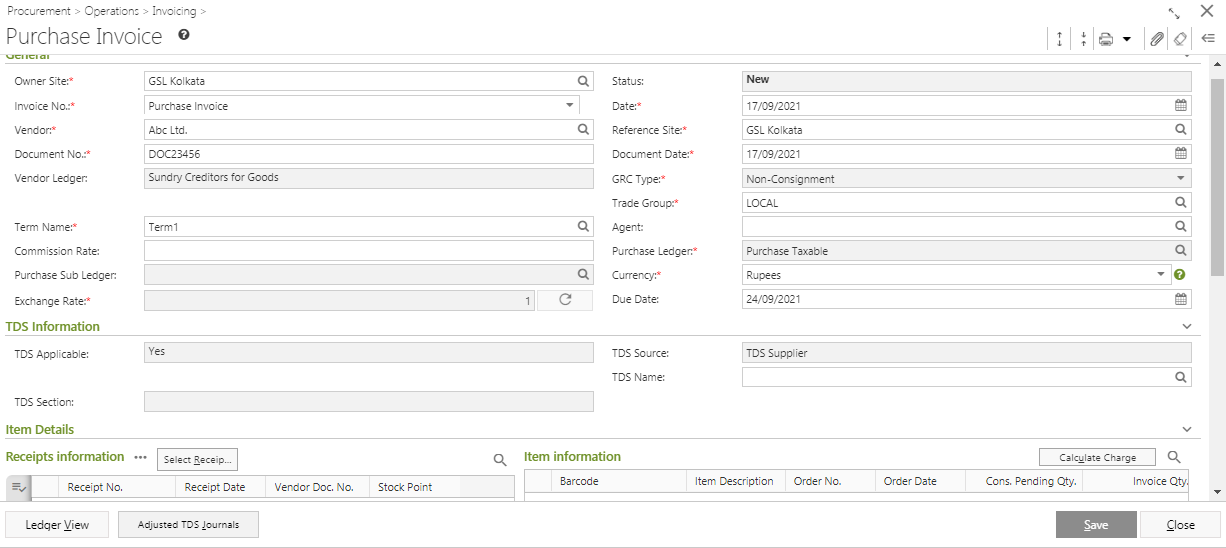

- Purchase Invoice window will open.

- Previously created Purchase Invoice will be listed.

- Click on the Add button.

- Purchase Invoice window will open.

- You will get group of icons at the top right corner of the window.

- The icons name from left to right are - Expand All, Collapse All, Print Document Report, Attachments, Clear Form and Open Side Panel.

- Expand All: Clicking on this icon, all the sections will be Expand if they are collapsed.

- Collapse All: Clicking on this icon, all the sections will be Closed if they are expanded.

- Print Document Report: Clicking on the Down Arrow beside this icon, you will get Print Preference option with already created Report File Template. This option is used to print document.

- Attachments: You can Upload some required documents from this option.

- Clear Form: Clicking on this icon, you can Clear all the data already entered.

- Open Side Panel: Clicking on this, you will get the details of the current Purchase Invoice as follows:

- Document Summary: In this section you will get the details of Selected Items, Sale Type, Owner Site, Modified by etc.

- Vendor Details: You will get the Selected Customer Details like Address, Contact Details, Tax Region, Credit Limit, Overdue Amount etc.

- Vendor Statistic: This section describes the Received not Invoiced amount, Outstanding Amount, Last Invoice Date etc.

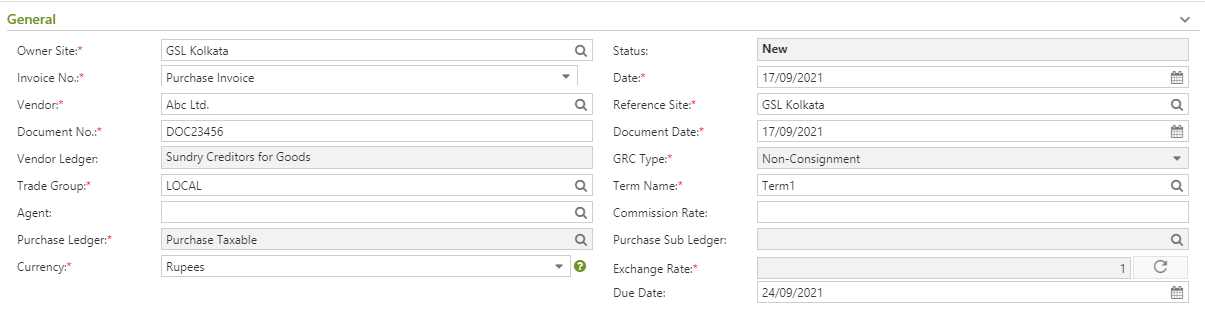

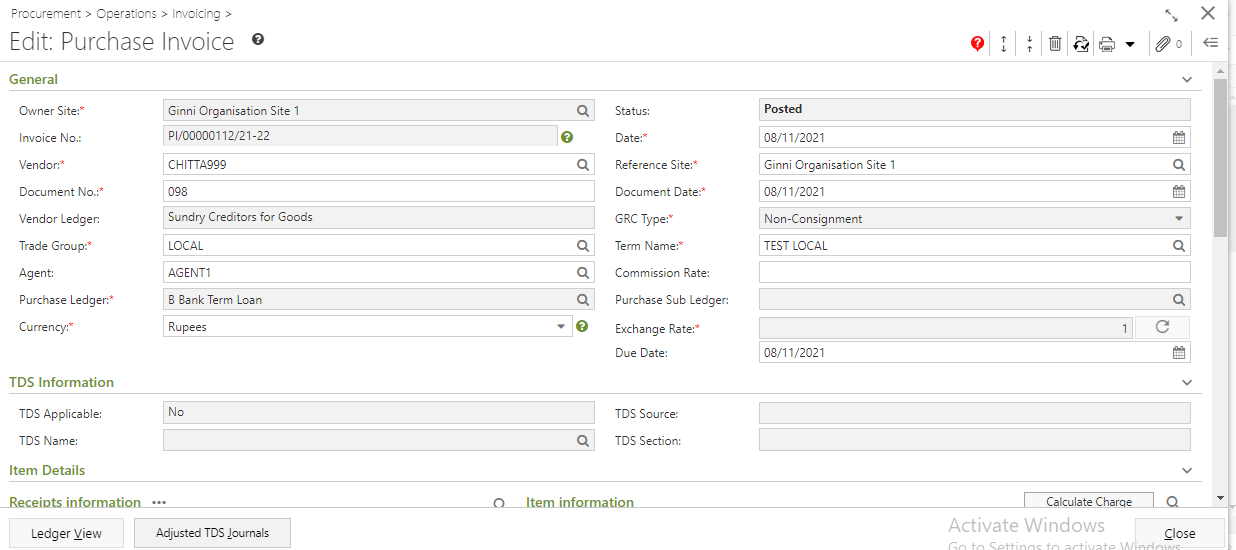

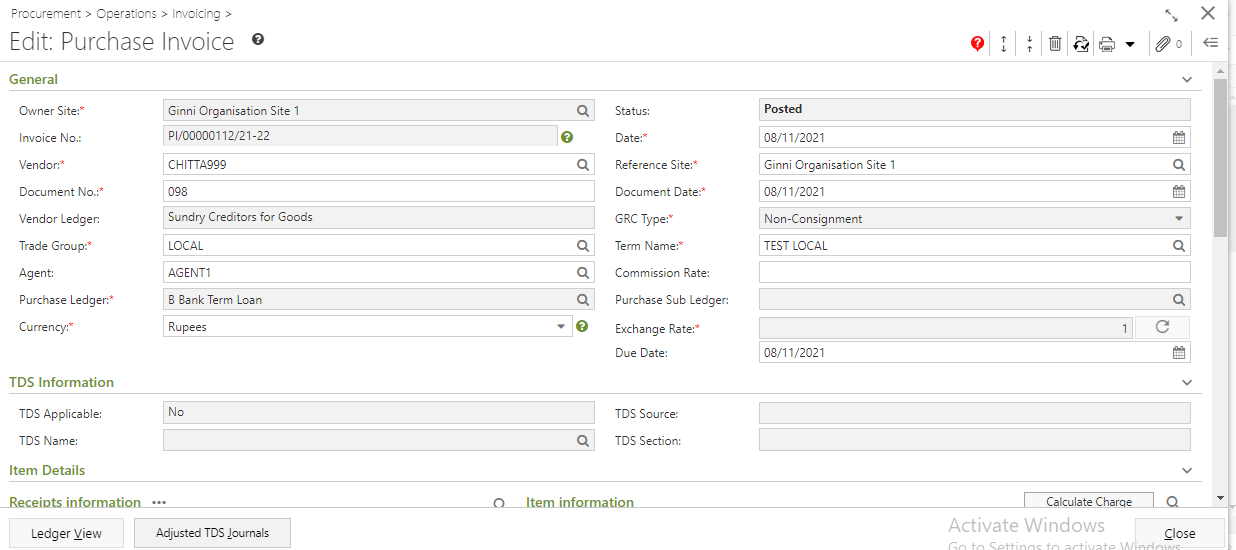

- You will get three section in the Purchase Invoice main form - General, Item Details and Others.

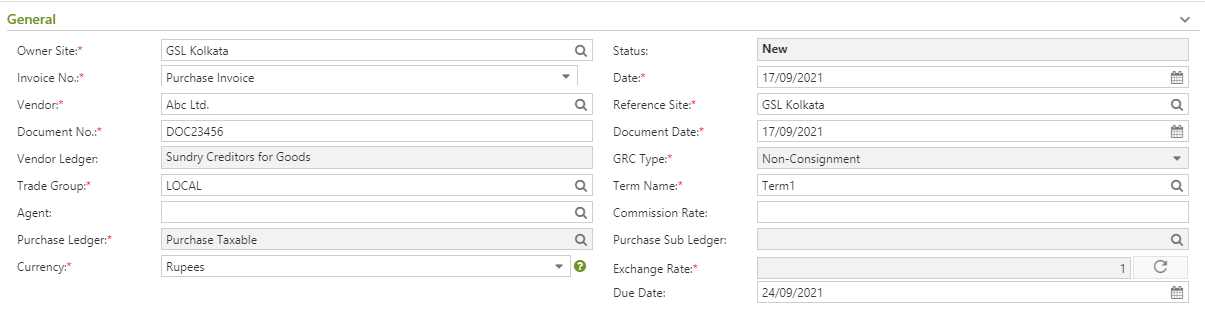

- General:

- Select the Owner Site (Mandatory Field) for which you want to create the Purchase Invoice.

- Select a Invoice No. (Mandatory Field) which is already created.

- Select the Vendor (Mandatory Field) from the drop down list.

- According to the selected Vendor, other fields like Reference Site, Trade Group, Term Name, GRC Type, Purchase Ledger, Currency etc will be populated.

- System Date will be populated in the Date field (Mandatory Field).

- Document No., Agent and Document Date are mandatory fields.

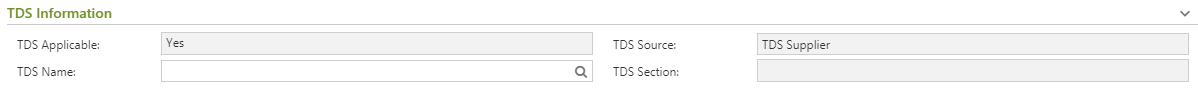

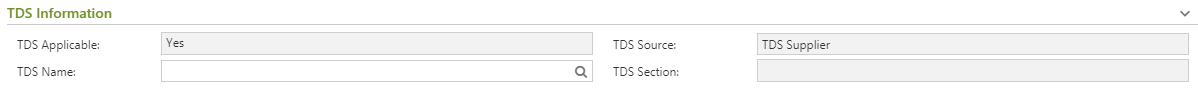

- TDS Information:

- TDS Information will be updated automatically as per Vendor.

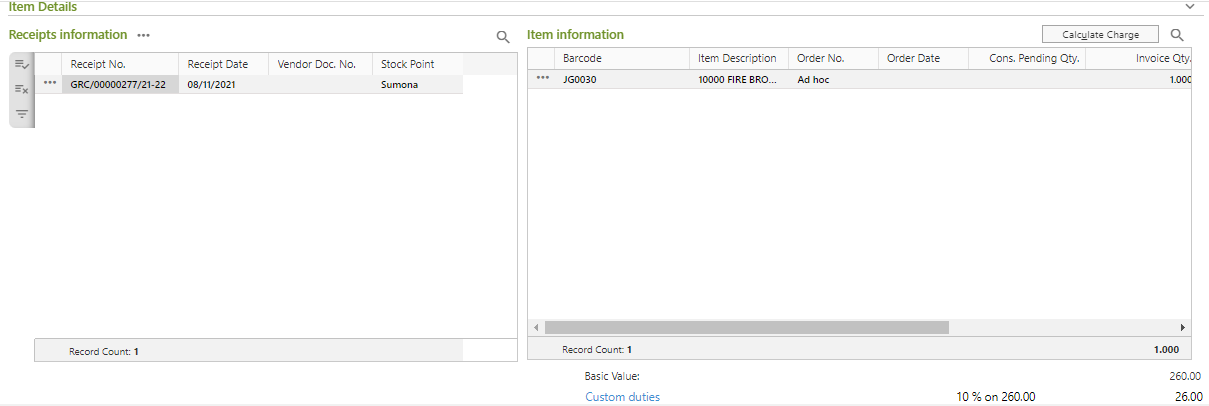

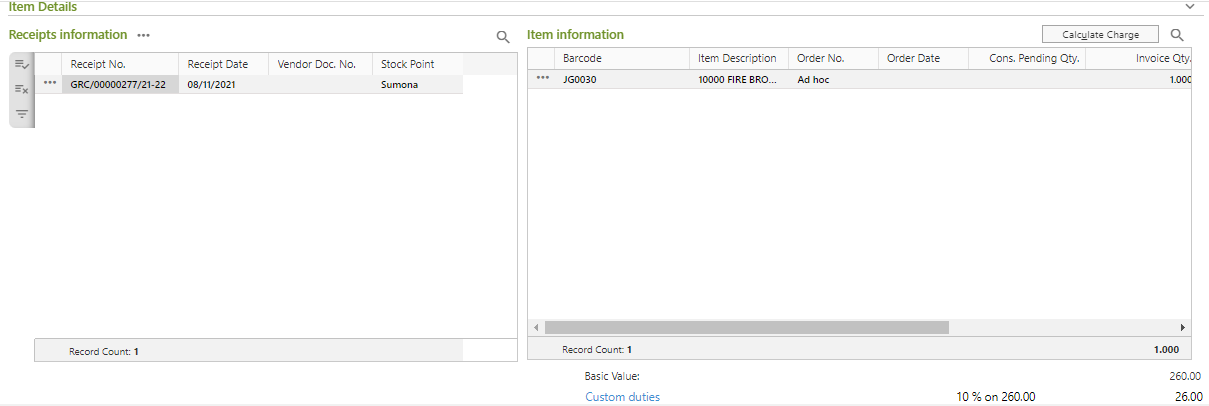

- Item Details:

- You will get two sections in the Item Details - Receipt Information and Item Information.

- Receipt Information:

- Click on Select Item Receipt.

Select Receipt window will open.

{page

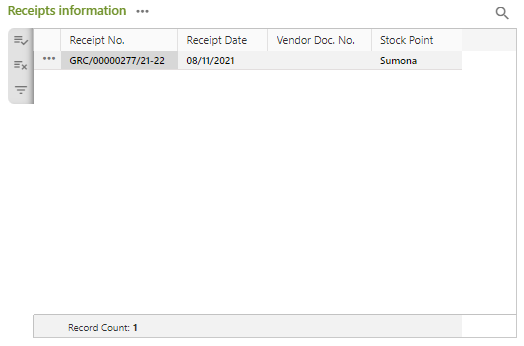

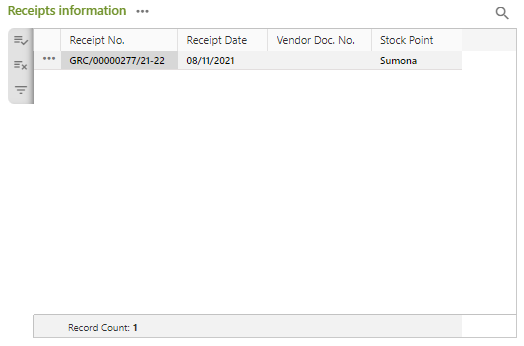

- You will get the list of GRC in the Receipt Information section.

- Select the GRC against which you want to return.

- The items, present in the selected GRC, will be populated in the Item Information section.

- Click on the OK button.

- The selected GRC will be populated in the Receipt Information section with Receipt Date, Vendor Doc No. and Stock Point.

- If you click on the

button left side of the populated GRC, you will get a drop down list.

button left side of the populated GRC, you will get a drop down list.

- You will get Delete Record and Item Charge.

- Delete Record: You can delete the populated item from the list as per your requirement.

- Item Charge: The charges applied on the particular item will be displayed by clicking on this option. However, you may change the factors of the charges applied based on the settings in your user profile.

- Item Information:

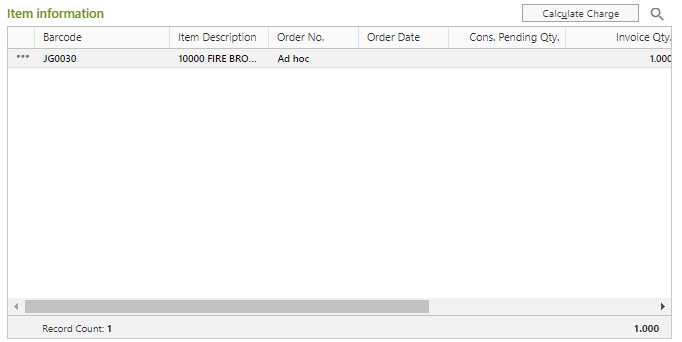

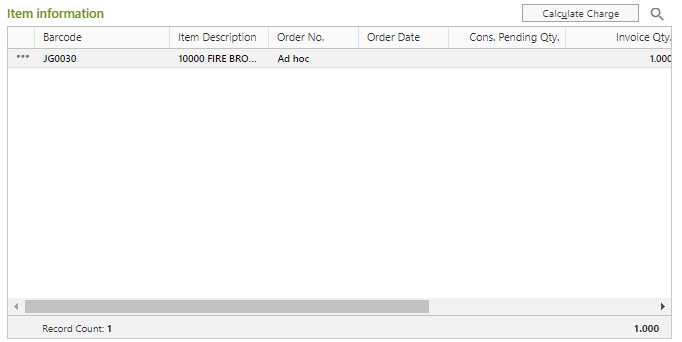

- The items, present in the selected GRC, will be listed in the Item Information section with Barcode, Item Description, Order No. etc.

- You can modify Invoice Qty. and Rate.

- If you click on the

button left side of the populated item, you will get a drop down list.

button left side of the populated item, you will get a drop down list.

- You will get Delete Record, Item Charge and View Properties.

- Delete Record: You can delete the populated item from the list as per your requirement.

- Item Charge: The charges applied on the particular item will be displayed by clicking on this option. However, you may change the factors of the charges applied based on the settings in your user profile.

- View Properties: You can check the item details by clicking on this option. It will open the Item Master window but you cannot edit any details.

- Others:

- You can also put in Remarks field in Others section.

- Now you need to calculate Charge. Click on the Calculate Charge button. But even if you skip this step, charges applied will be automatically calculated on saving the form.

- Charge will be calculated and the final amount after charge application will be populated as Net Amount.

- If you click on any applicable charge, Applicable Item window will open. You can alter the charge factor if you have enabled the proper user profile setting. The applicable charge amount or discount amount will be divided between all the items.

- Click on the Save button to save Purchase Invoice. You will get a message - "Document <Purchase Debit No:> saved successfully."

Edit Purchase Invoice

Prerequisites

- The users' role must have access to the Edit app operation in the Purchase Invoice feature in Procurement - Operation - Invoicing through Roles in Ginesys Web - Admin - Security.

- Purchase Invoice must be created and Un-Posted.

Step-by-step guide

The steps are as follows:

- Go to Ginesys Web > Procurement > Operation > Invoicing > Purchase Invoice.

- Purchase Invoice window will open.

- Previously created Purchase Invoice will be listed.

- Select the PI you want to edit.

You can use Filter to search particular PI(s).

- Edit: Purchase Invoice window will open.

- All the details will be populated.

- You will three new icons at the top right corner of the window - Show Message, Delete and Revert.

- Show Message: You will get a message regarding edit of Purchase Invoice.

- Delete: You can Delete the Purchase Invoice from the Edit Mode by clicking on this icon.

- Revert: You can Revert the Purchase Invoice from the Edit Mode by clicking on this icon.

- If you want to modify the Vendor, you need to remove the Receipt. Otherwise you will get a message - "Please remove the receipt(s) before changing the Vendor.". Others details will be changed as per Vendor changed.

- You can modify Agent, Reference Site, Term etc.

- You can also modify and delete Receipt and Items.

- Click on the Save button to save the modified Purchase Invoice.

- You will get a message - "Document <Purchase Debit No:.> saved successfully."

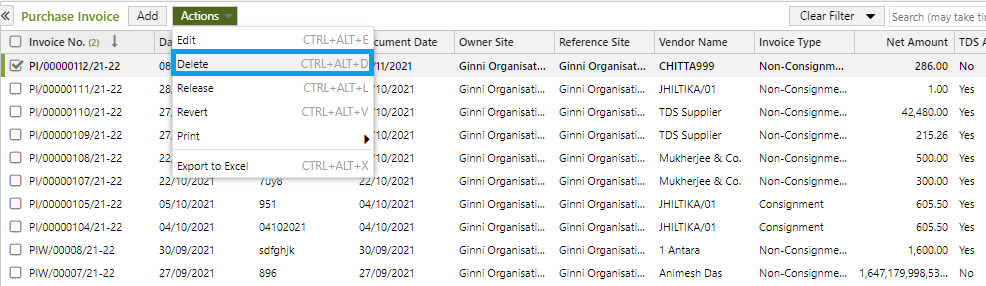

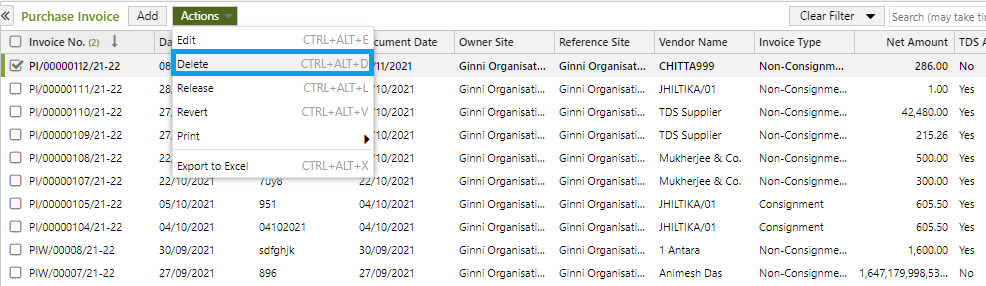

Delete Purchase Invoice

Prerequisites

- The users' role must have access to the Delete app operation in the Purchase Invoice feature in Procurement - Operation - Invoicing through Roles in Ginesys Web - Admin - Security.

- Purchase Invoice must be created and Un-Posted.

- Purchase Invoice must not be Released.

Step-by-step guide

The steps are as follows:

- Go to Ginesys Web > Procurement > Operation > Invoicing > Purchase Invoice.

- Purchase Invoice window will open.

- Previously created Purchase Invoice will be listed.

- Select the PI you want to delete.

- You can use Filter to search particular PI(s).

- Go to Acton > Delete.

- You will get a message - "Document once deleted cannot be retrieved. Do you want to delete this document?"

- If you click on Yes, you will get a confirmation message "<Purchase Debit No::> - Successfully deleted".

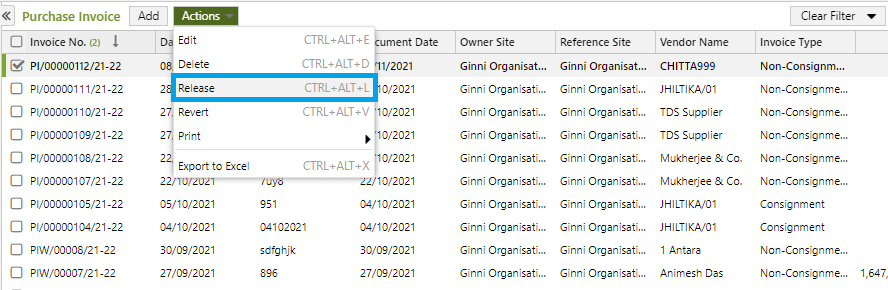

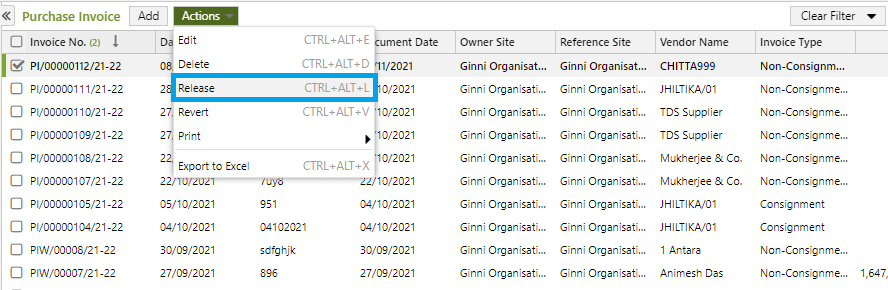

Release Purchase Invoice

Prerequisites

- The users' role must have access to the Release app operation in the Purchase Invoice feature in Procurement - Operation - Invoicing through Roles in Ginesys Web - Admin - Security.

- Purchase Invoice must be created and Un-Posted.

- Purchase Invoice must not be Released.

Step-by-step guide

The steps are as follows:

- Go to Ginesys Web > Procurement > Operation > Invoicing > Purchase Invoice.

- Purchase Invoice window will open.

- Previously created Purchase Invoice will be listed.

- Select the PI you want to release.

- You can use Filter to search particular PI(s).

- Go to Acton > Release.

- You will get a message - "Document(s) once released cannot be modified. Do you want to proceed?"

- If you click on Yes, you will get a confirmation message "Debit No <Purchase Debit No:> - Released Successfully ".

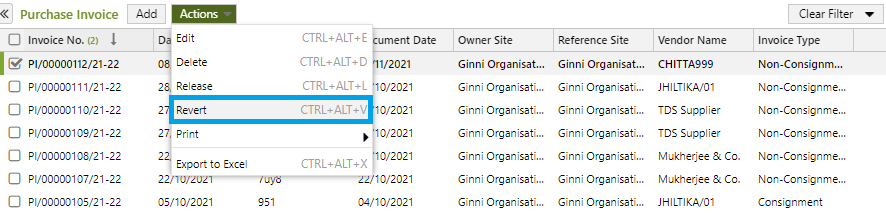

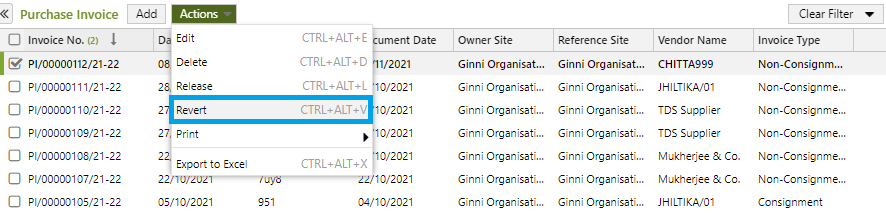

Revert Purchase Invoice

Prerequisites

- The users' role must have access to the Revert app operation in the Purchase Invoice feature in Procurement - Operation - Invoicing through Roles in Ginesys Web - Admin - Security.

- Purchase Invoice must be created and Un-Posted.

- Purchase Invoice must not be Released.

Step-by-step guide

The steps are as follows:

- Go to Ginesys Web > Procurement > Operation > Invoicing > Purchase Invoice.

- Purchase Invoice window will open.

- Previously created Purchase Invoice will be listed.

- Select the PI you want to release.

- You can use Filter to search particular PI(s).

- Go to Acton > Revert.

- You will get a message - "Finance postings of the selected document(s) will be reverted. Auto DN/CN, if any, will also be deleted. Do you want to proceed?"

- If you click on Yes, you will get a confirmation message "Invoice No. <Purchase Debit No:> - Reverted Successfully ".

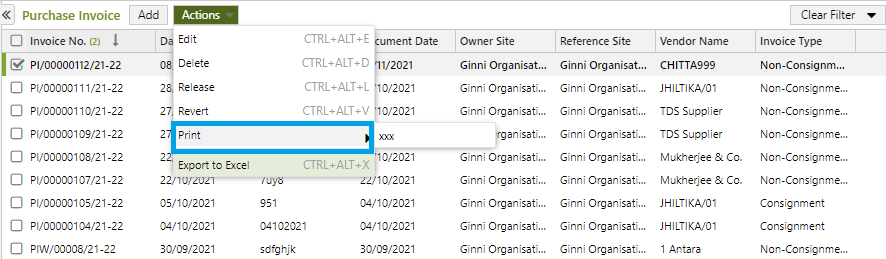

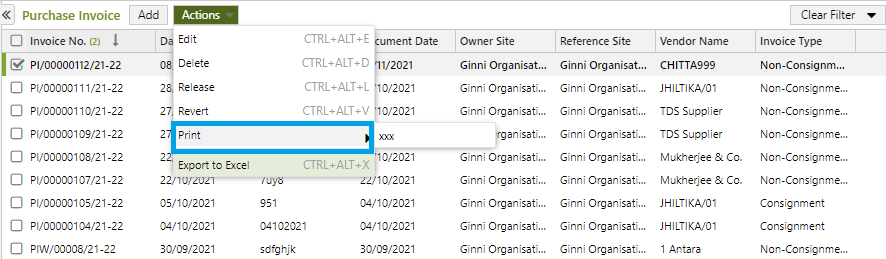

Print Purchase Invoice

Prerequisites

- The users' role must have access to the Revert app operation in the Purchase Invoice feature in Procurement - Operation - Invoicing through Roles in Ginesys Web - Admin - Security.

- Purchase Invoice must be created.

- Printer must be connected to the device.

Step-by-step guide

The steps are as follows:

- Go to Ginesys Web > Procurement > Operation > Invoicing > Purchase Invoice.

- Purchase Invoice window will open.

- Previously created Purchase Invoice will be listed.

- Select the PI you want to print.

- You can use Filter to search particular PI(s).

- Go to Acton > Print.

- You will get previously created template.

- Click on the required template to print.

- A new window will open.

Click on the Print to print the Purchase Invoice.