We’re excited to announce that the latest information is now available on our new site, the Ginesys One Wiki!. Visit the site for up-to-date resources and insights. We look forward to continuing to support you there!

We’re excited to announce that the latest information is now available on our new site, the Ginesys One Wiki!. Visit the site for up-to-date resources and insights. We look forward to continuing to support you there!

Release Note 11.146.3

Control

| Release Date | 15 June, 2019 |

| HO Version | 11.146.3 |

| POS Version | 1.146.0 |

| Web Database Compatibility Version | 1.16 |

| Features & Enhancements | 06 |

| Bug Fixes | 00 |

| Navigation |

|

Features & Enhancements

Serial | Dev ID | Idea Tracker | Description | |

|---|---|---|---|---|

| 1 | 13266 | GIN-I-1685 | 13266 Purchase Service Debit Note introducedModules: Feature Video:

Enhancement Summary: There can be scenarios where your service vendor issues a credit note to you due to rate difference, bad-service settlement discount, etc. In Ginesys till date, we used to provide the following provisions: Purchase Debit/Credit Note which involved goods movement. The aforementioned scenarios were possible using Finance Debit Note / Credit Note module. However, since the GST requirement is upload data invoice wise - HSN wise, the effort required to capture the details in reference columns was unjustifiable and same problem was with return uploading manual effort. To ease down the operations, Ginesys introduces new Service Debit Note module for Procurement of Service. In other words, whenever a service vendor issues a credit note to you, you can now book the debit note in the system against the invoice. To make an entry, please follow the following steps:

Note: In case you deducted TDS in Service Invoice and want to reverse/reduce it post Service Debit Note creation, you can do that using the TDS reversal module (details specified below). Document Report: This is the one of the transactions which will only have Web Reports document reports. No legacy fixed type document report will be provided for this transaction. You can refer this video for the process of tagging a web document report to Ginesys Desktop transactions: https://www.youtube.com/watch?v=bhpjH_idrGU If you are yet to configure Ginesys Web Reports, please follow the following link: Ginesys Reports Installation Guide Purchase Service Credit Note is equivalent to Purchase Service Invoice We didn't find any live case during analysis where a service vendor issues a debit note (against which you book Service Credit note in your system). So we have not provided any provision for this. In case you face any such case, it is recommended to ask the service vendor to issue a differential service invoice. | |

| 2 | 13267 | GIN-I-1685 | 13267 TDS reversal introducedModules: Feature Video:

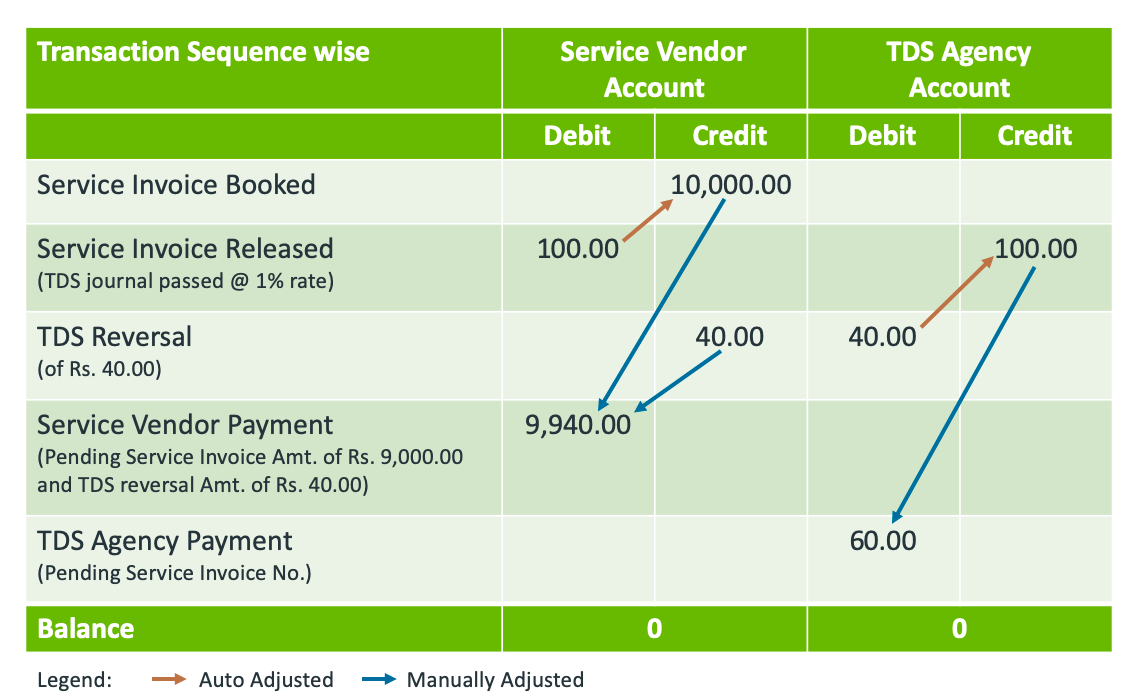

Enhancement Summary: At times, post deduction of TDS, there are cases (very rare though) where you would required to either reduce the deducted TDS amount or simply reverse the same. However, till date, it had to be done manually using Debit or Credit journal. Accordingly, TDS payment/filing had to be manually taken care off. But now with this update you can reverse the TDS using the new module. New TDS Reversal Entry:

Reporting:

Modifying TDS Reversal Entry: Impact in TDS Exception Calculation: | |

| 3 | 16263 | GIN-I-2347 | 16263 Release of Purchase DN/CN is now allowed even without specifying the vendor's CN/DN detailsModules: Feature Video:

Enhancement Summary: Why was the release restricted for Purchase DN/CN if document number & date was not provided? To ensure proper tallying, the system restricted the user from releasing the document when counter-party's debit/credit note number was not fed into the system. Note: This information was fed in the document number and date of the transaction. What were the challenges being faced due to the aforesaid restriction? GSTR3B needs to be filed first and then GSTR1/GSTR2 needs to be filed at a later date. Now for generating GSTR3B, all information needs to be available in EasemyGST which is not getting possible. Only released/posted transactions get synced to EasemyGST. Since the vendors are not issuing debit/credit notes timely, you were not able to file GSTR3B as well. Also, matchmaking is not required as of now, so GSTR2 was also not getting filed. Solution released:

Matchmaking in EasemyGST will be manual In case the documents are released without specifying the vendor's CN/DN details. The match making process at EasemyGST end for these DN/CN will be manual. For more details please contact EasemyGST support. | |

| 4 | 16264 | GIN-I-2370 | 16264 Goods from multiple invoices are now allowed in a single Purchase Return Debit NoteModule: Feature Video:

Enhancement Summary: Previously, whenever the user tried to tag multiple GRT documents (which were billed in different GST invoices) in a single transaction, the system used to restrict the user and asked them to treat this type of transaction as an Outward Supply. This restriction was applicable due to GST rules, i.e., a single debit/credit note can have only single invoice number. However, recently, the Government has allowed to issue a single debit/credit note against multiple invoices. Accordingly, the system will now allow user to tag multiple invoice GRT documents in a single Purchase return transaction. Note: Amended GST rules have placed a clause of invoices allowed should be of single accounting year only. The vendor's invoice date (Purchase Invoice's reference document date) shall be considered in this derivation and not the Purchase Invoice entry date. Few Important warnings/information The return filing process is yet not corrected with the amended rules. So, the following points should be noted:

| |

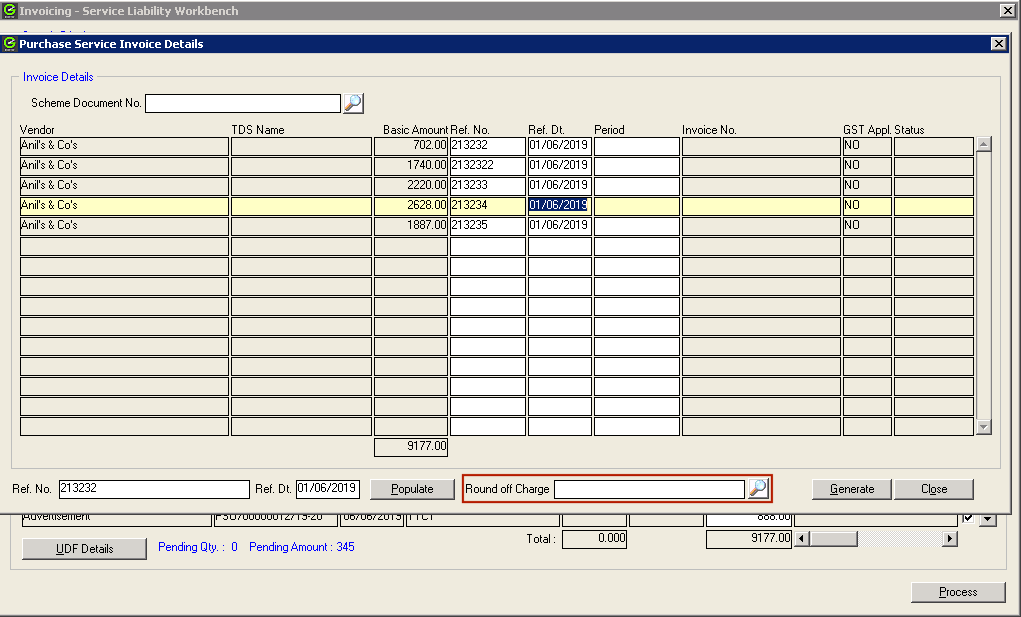

| 5 | 16262 | GIN-I-2248 | 16262 Service Invoices generated from Service Liability Workbench can now be rounded off to nearest 1 RupeeModule: Ginesys Desktop - Procurement - Invoicing - Service Liability Workbench Enhancement Summary: Steps for the same are as follows:

Conditions where auto round-off will NOT work: The selected charge already exists in the selected term (for the vendor) but is not the last charge (as per the seq.). | |

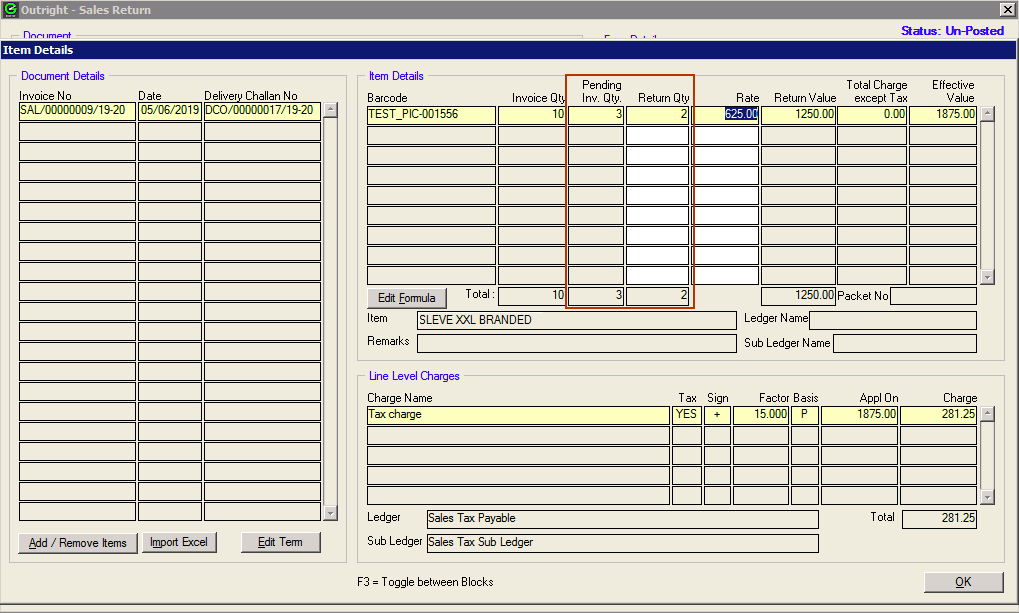

| 6 | 16265 | N.A. | 16265 Quantity editing for Sales Return transactions from Unmanaged Stores made easyModule: Ginesys Desktop - Sales & Distribution - Outright - Sales Return Enhancement Summary: Note: This is allowed only when transaction is being prepared against returns from unmanaged stores. Reason - GRT (done from store) is set-off when this transaction is done, so manual editing of quantity cannot be allowed. | |